Emerging Trends in Financial Software Development

The realm of financial technology, commonly referred to as FinTech, is undergoing rapid expansion. At its core, software development stands as a pivotal force, driving innovation, shaping user experiences, and adapting to evolving consumer expectations. In this discourse, we delve into the insights of software development within the FinTech domain, particularly focusing on how it intersects with changing consumer expectations, notably influenced by the Millennial generation.

The surge of technological advancements has propelled the FinTech sector into uncharted territories, challenging traditional models with novel solutions. Software development, serving as the catalyst for this transformation, is instrumental in crafting digital products and services that transcend the confines of conventional finance.

Evolution in Consumer Expectations Consumers, now accustomed to seamless digital interactions, harbor elevated expectations regarding innovation within the financial realm. Software development emerges as the fulcrum upon which user satisfaction hinges, providing interfaces that are not just user-friendly, but also secure and personalized.

A staggering 70% of users of online financial services deem user experience pivotal in selecting their service provider.

Emerging Trends in Financial Software Development

- Harnessing Artificial Intelligence (AI) and Predictive Analytics The integration of AI and predictive analytics is revolutionizing financial decision-making processes. Advanced algorithms dissect spending patterns, anticipate user behaviors, and furnish personalized advice, ushering in a more proactive and adaptable user experience.

Machine learning models exhibit remarkable accuracy in forecasting user spending behaviors.

- Embracing Blockchain for Enhanced Security Beyond its association with cryptocurrencies, blockchain technology finds extensive applications in financial domains. It guarantees unparalleled transparency, fortifies transaction security, and streamlines verification processes, thereby addressing the escalating cybersecurity mandates.

Companies leverage blockchain to fortify transaction security and bolster user trust.

- Facilitating Conversational Interfaces and Contextual User Experience (UX) Conversational interfaces, propelled by machine learning, are reshaping user interactions with financial platforms. Chatbots and virtual assistants promise seamless and personalized experiences, simplifying banking operations and fortifying customer loyalty.

Certain online banks distinguish themselves through innovative utilization of conversational interfaces, offering an intuitive user experience that resonates particularly with Millennials.

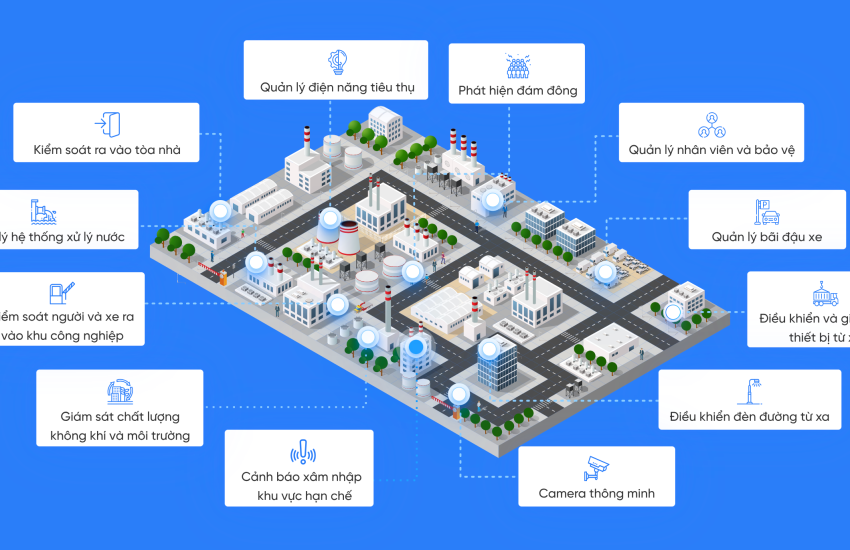

Are you considering developing a FinTech application while maintaining cost-efficiency and quality? Explore our overseas offices, particularly in Asia, where assembling a tech team in Vietnam is seamlessly feasible. Initiate web application development in Vietnam through our agency based in Ho Chi Minh City. Reach out to us, and let’s align your expectations and requirements. Offshore IT ventures have propelled numerous companies in the software market, courtesy of economic advantages that yield significant differentiators.

The Millennial Generation: Catalysts for Change Generation Y, encompassing individuals born between the early 1980s and mid-1990s, assumes a pivotal role in reshaping expectations pertaining to financial services. They seek agile, transparent solutions that align with their values.

An overwhelming 80% of Millennials prefer managing their finances through mobile apps, underscoring the significance of accessibility and user-friendliness.

As the vanguards of digital evolution, Millennials wield substantial influence over the development and adoption of financial applications. Their penchant for user-friendly mobile apps has propelled the demand for intuitive and secure features to unprecedented heights.

Attuned to transparency and ethics, Millennials gravitate towards financial services that resonate with their values. They exhibit burgeoning interest in participatory investment, propelling the ascendancy of online platforms. Ultimately, their quest for flexibility and customization in financial management guides their application preferences.

By shaping technological advancements, digital natives expedite the assimilation of new technologies. Their acute vigilance regarding security and privacy underscores the imperative of robust measures in financial applications.

Author : Saigontech.io