The Transformative Influence of Big Data on the Fintech Sphere 🚀

In light of World Data Protection Day on January 28, 2024, let’s delve into the profound impact of big data on the future trajectory of fintech.

How Does Big Data Reshape Fintech? Enterprises spearheading digital innovations to optimize financial services are witnessing a seismic shift propelled by the advent of big data.

Big data is currently revolutionizing the fintech landscape, particularly in bolstering data security and fortifying fraud detection mechanisms.

By harnessing AI alongside data analytics, companies can craft intricate customer profiles and preempt suspicious activities.

Alternative data, dubbed as big data in the fintech domain, finds applications in:

- Online payments 💳

- Insurtech (digital insurance)

- Lending

- Trading

For instance, Greather Than leverages GPS data from drivers to gauge accident probabilities and environmental impact.

Moreover, big data harnesses insights from social media platforms to gauge credit risks, align with evolving customer preferences, and streamline fraud detection mechanisms.

Furthermore, big data facilitates data-driven decision-making, thereby enhancing operational efficiency and enriching customer experiences. Additionally, it acts as a catalyst for the rise of open banking, fostering integrated and personalized financial services while affording consumers greater control over their data. Open banking, adopted by banks and financial institutions, entails making data universally accessible, fostering its unrestricted usage and dissemination.

In the realm of finance, information reigns supreme 🪙

Asset managers, in particular, rely on a steady influx of data to inform their investment decisions. Each data point can sway stock prices 📈, influence bond yields, or determine portfolio valuations.

The financial sector, a voracious consumer of data, depends on these specialists to satiate its unquenchable thirst for information. Investors, be it institutions or individuals, demand swift, accurate, and pertinent data to maintain their competitive edge. They turn to financial information specialists to glean insights that inform their decisions 💡.

Alternative Data: The New Frontier for Asset Managers The financial landscape has witnessed an influx of new players translating information into high-value market insights 🧐, thanks to the advent of big data and alternative data. These agile startups, armed with innovative algorithms, mine social media platforms like Twitter and Reddit, analyzing trends and sentiments to generate actionable trading signals.

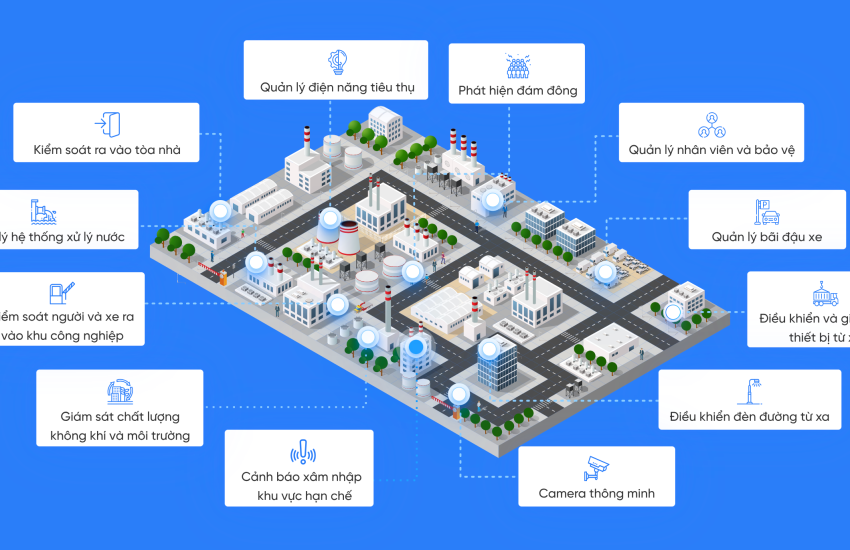

Looking to leverage the benefits of big data for your financial application? Explore our Vietnam offshore software development center to develop a bespoke application at reduced costs!

The use of satellite imagery 🛰️ to gauge economic activity, such as parking analysis to forecast retail sales, has emerged as a potent tool. Likewise, mobile data serves as a unique barometer of consumer behaviors, offering insights into a company’s future performance when aggregated and analyzed.

This alternative data is distilled by specialists who decipher vast troves of unstructured data, transforming raw information into actionable insights. Portfolio managers, in turn, leverage these insights to make informed market positions, foreseeing company outcomes before they surface in the public domain.

The significance of this data in investor decision-making underscores a seismic transformation in the financial landscape. The ability to interpret and act on alternative data confers a competitive edge, empowering asset managers to make astute decisions, mitigate risks, and optimize returns for investors.

Companies Harnessing Big Data in Financial Services Here are some exemplars leveraging big data in their operations:

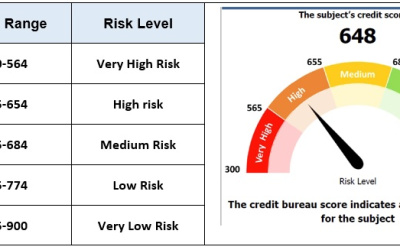

- Ant Financial Services Group – Ant Financial employs big data to assess creditworthiness and extend loans to SMEs and consumers lacking traditional credit histories. Zhima Credit, their credit scoring technology, scrutinizes data from diverse sources to evaluate users’ credit profiles.

- Square, Inc. – Utilizing big data, Square offers loans to small businesses via its point-of-sale system. Square Capital assesses a company’s financial health by analyzing daily transactions and sales patterns to ascertain loan eligibility and terms.

- Credit Karma – Credit Karma furnishes tailored credit card and loan recommendations by analyzing users’ credit data. Additionally, it employs big data to help users monitor credit health and flag potential fraud risks.

These companies exemplify innovative use of big data, furnishing more accurate, personalized, and efficient financial services, thereby enriching user experiences and driving decision-making in personal and business finance.

The Impact of Alternative Data on Financial Analysis: Navigating Short-Term Insights and Long-Term Strategy The integration of alternative data into financial analysis reshapes analysts’ forecasts and expectations, particularly concerning timing.

While enriching short-term forecasts, this data, often focused on immediate trends, poses a conundrum, potentially obscuring long-term strategic vision ⚠️. The deluge of instantaneous information, coupled with AI processing, tends to prioritize immediacy over enduring strategic perspectives.

This influx of short-term data presents a dual-edged sword. It empowers analysts with heightened predictive prowess 🔮, enabling them to capitalize on swift market shifts and nascent trends. However, this hyper-focus on the present sometimes eclipses comprehension of underlying trends and long-term dynamics shaping companies and markets.

This poses a challenge for investment strategies: striking a delicate balance between leveraging immediate data for short-term gains and preserving a strategic outlook that encompasses long-term trajectories. In essence, while AI and advanced analytics furnish invaluable insights, their efficacy wanes when navigating the complexities of long-term forecasting and sustainable investment strategies.

This observation underscores a pivotal query for the financial realm:

How can we judiciously integrate alternative data to enrich, rather than constrict, our financial foresight?

Striking a harmonious balance between these disparate time horizons is imperative in shaping the future of financial analysis and strategic decision-making.

In conclusion, big data and alternative data herald a paradigm shift in the fintech domain. Fintech enterprises, through adept big data utilization, deliver unprecedented personalization, fortify security, and lay the groundwork for a more integrated financial landscape via open banking.

Armed with increasingly sophisticated analytical tools, asset managers can now anticipate market movements with unparalleled precision. However, the profusion of short-term data necessitates profound reflection on its long-term ramifications. Investment strategies must adapt, capitalizing on immediate benefits while preserving a strategic, sustainable vision.

In this epoch of knowledge, as aptly encapsulated by philosopher and sociologist Edgar Morin:

“We are in the era of knowledge.

Knowledge is the key to everything.”

In the financial realm, this knowledge is fueled by big data, unlocking unprecedented opportunities while challenging our ability to transcend immediate horizons. To navigate this knowledge era, fintech stakeholders and investors must remain vigilant, adept at integrating new data while cognizant of long-term implications, ensuring not only economic prosperity but also financial sustainability for posterity 🌎.

Embarking on developing a financial application to furnish consumers with market insights but require budget-friendly developers? Look no further! At our Vietnam offshore software development center, craft the bespoke application you envision, all while keeping costs in check.